A documentary letter of credit is a guarantee of from the issuer (i.e. issuing bank) to the beneficiary that the issuer will pay the beneficiary money when the beneficiary provides certain documents to the issuer in a certain manner time and place.

What is a documentary

letter of credit?

A documentary letter of credit is issued by a bank or a financial institution. The letter of credit assures the supplier (beneficiary) that they will receive payment up to the amount stated in the letter of credit, provided that the beneficiary makes a compliant document presentation.

Once the beneficiary makes a compliant presentation, the Issuing institution will make a payment. Even if the buyer (applicant) cannot pay for the beneficiary’s services, the issuer is obliged to honor the presentation.

Documentary letters of credit are mostly used in international transactions, where the buyer and seller have yet to establish a strong relationship and/or operate in different countries. When concluding a deal with a buyer from a different country, the seller is exposed to risks due to the physical distance between the two parties, foreign or unknown legal systems, and lack of knowledge about the buyer. A seller may be hesitant to enter such a risk-sensitive deal without a letter of credit as financial security.

In these cases the credit worthiness of the issuer stands in place of the credit worthiness of the buyer – giving the supplier greater comfort that he will be paid.

How

Does it Work?

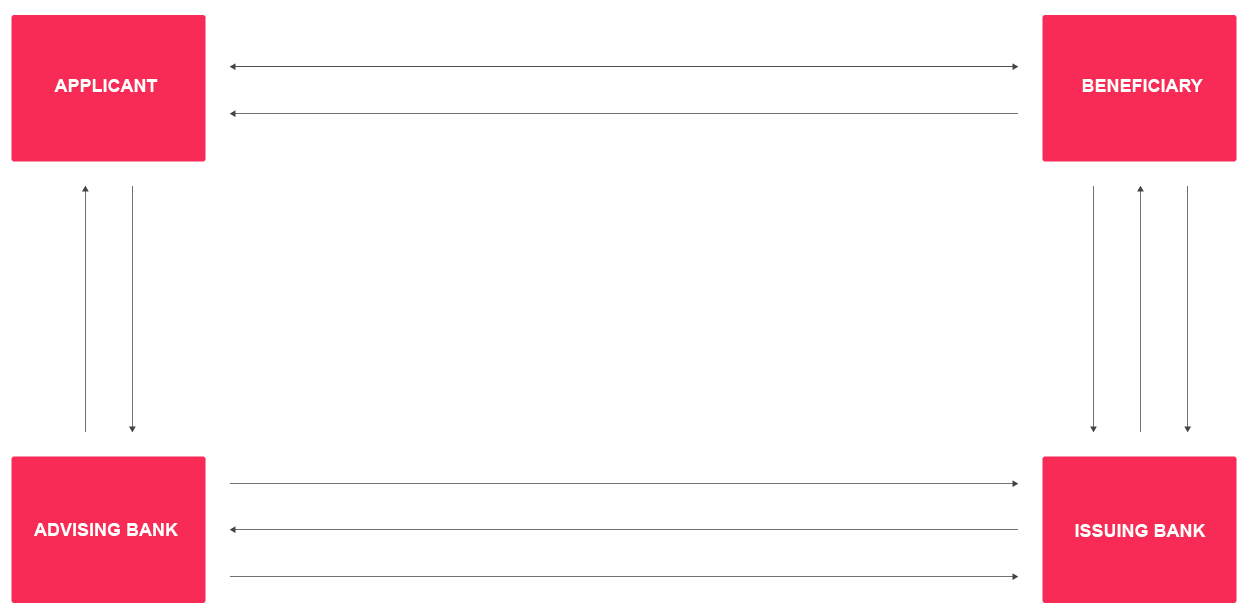

A documentary letter of credit requires that the Beneficiary present specific documents before its expiration. These documents relate directly to the deal between the Beneficiary and the Applicant; they show that the Beneficiary has fulfilled his part of the transaction. Once the Beneficiary makes a compliant presentation, the issuer pays regardless of the Applicants actions. An issuer might make a payment even if he finds a technical discrepancy in the documents, so long as he is confident that the deal is going as planned.

When an applicant takes advantage of a documentary letter of credit, he frees up capital that would otherwise be tied up with the beneficiary the form of a security deposit. Due to this ability to boost an applicant’s cash flow, documentary letters of credits are a very important aspect of international trade for deals of all sizes.

The Uniform Customs and Practice for Documentary Credits (UCP) lays the legal framework for all documentary letter of credit. The current version is UCP600, which became effective on July 1st, 2007.

Our DLC Process